Ready to grow?

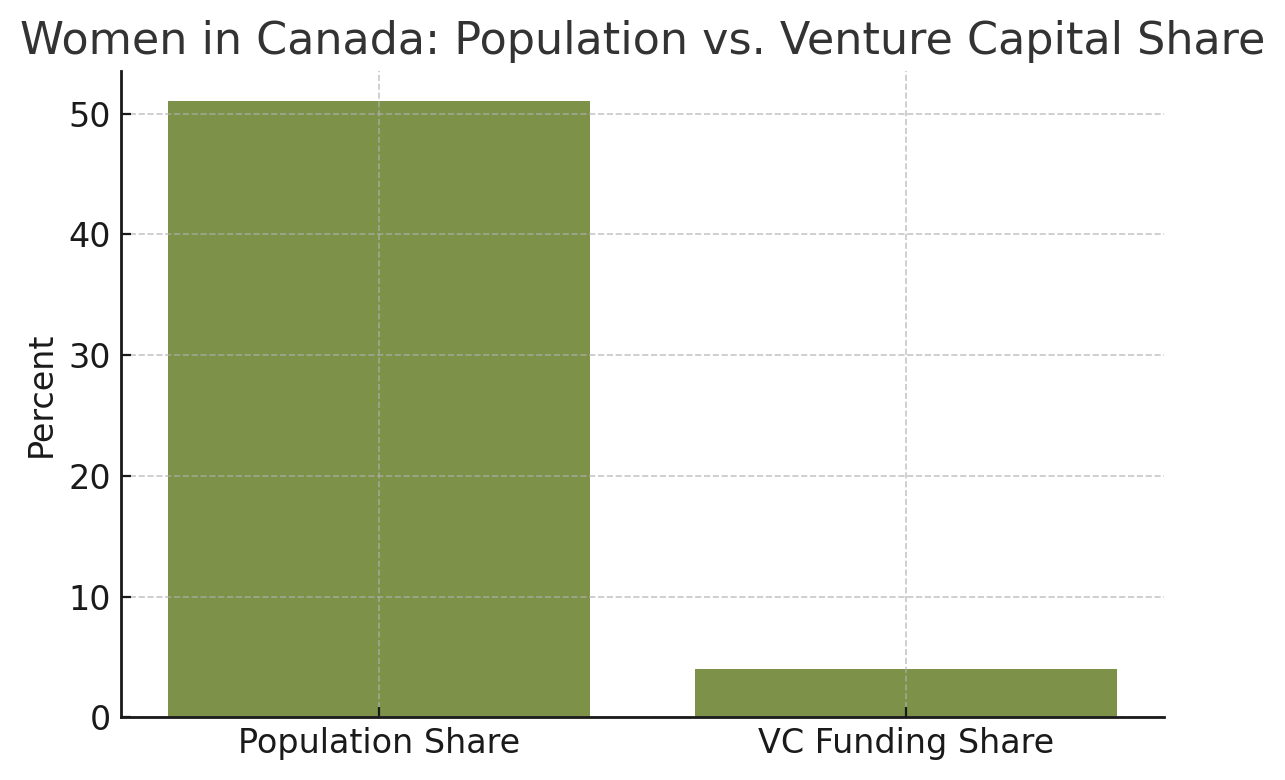

If it’s time to grow your agri-food business but, like many women, BIPOC, and gender diverse entrepreneurs, you worry about the challenges and barriers you could face in finding financing – this program provides you with the insight, know-how, and resources you need.